The global rodenticides market, a critical segment of the pest control industry, is experiencing a period of significant transformation. Driven by urbanization, climate change, and increasing awareness of rodent-borne diseases, the market is growing steadily. However, it faces mounting challenges from stringent environmental regulations and a shifting consumer preference towards safer, more sustainable solutions. This article explores the key drivers, restraints, trends, and future outlook of this dynamic market.

Market Overview and Key Drivers

Rodenticides are pesticides designed to kill rodents, primarily rats and mice. The market is segmented by type (anticoagulants and non-anticoagulants), form (pellets, blocks, powders, sprays), end-use (agricultural fields, warehouses, urban centers, residential), and mode of application (baits, fumigation, powders).

Primary Growth Drivers Include:

-

Rapid Urbanization and Globalization: Expanding cities create ideal habitats for rodents through increased waste and shelter. Global trade facilitates the spread of rodent species, necessitating professional pest control in ports, logistics hubs, and food supply chains.

-

Public Health Concerns: Rodents are vectors for diseases such as Leptospirosis, Hantavirus, and Salmonella. The post-pandemic world has heightened sensitivity to zoonotic diseases, pushing governments and businesses to invest in robust rodent management programs.

-

Threat to Food Security: Rodents are a major cause of pre- and post-harvest losses in agriculture. They consume and contaminate stored grains, impacting food supply and driving demand in the agricultural sector.

-

Climate Change: Milder winters in many regions lead to higher rodent survival rates and extended breeding seasons, increasing infestation pressures.

Market Restraints and Challenges

Despite strong demand, the rodenticides industry navigates a complex landscape of constraints:

-

Environmental and Regulatory Stringency: Second-generation anticoagulant rodenticides (SGARs), while effective, pose risks of secondary poisoning to non-target wildlife (e.g., birds of prey, pets). Regions like North America and the European Union have implemented strict bans or use restrictions, pushing the industry toward reformulation.

-

Development of Resistance: Rodents, particularly in urban areas, have developed genetic resistance to common anticoagulants, reducing the efficacy of traditional solutions.

-

Rise of Non-Chemical Alternatives: Growing adoption of mechanical traps, ultrasonic devices, and integrated pest management (IPM) practices, which emphasize prevention and non-lethal control, presents a competitive challenge.

Key Trends Shaping the Future

Innovation and adaptation are defining the market’s evolution:

-

Shift Towards Safer Chemistry: There is a clear trend toward non-anticoagulant rodenticides (e.g., cholecalciferol, bromethalin) and first-generation anticoagulants (FGARs), which are often perceived as having a lower environmental persistence. The development of novel actives with species-specificity and lower toxicity profiles is a key R&D focus.

-

Dominance of Professional Pest Control (PPM): The most significant trend is the growing market share held by professional pest management services. Regulations often restrict the sale of potent rodenticides to licensed professionals, who use them as part of Integrated Pest Management (IPM) strategies. This shifts revenue from over-the-counter products to service contracts.

-

Digitalization and Monitoring: The integration of digital bait stations with IoT sensors is revolutionizing the industry. These devices provide real-time data on rodent activity, bait consumption, and location, enabling proactive, data-driven pest management and reducing unnecessary chemical use.

-

Biodegradable and Natural Product Development: While a niche segment, demand is rising for products derived from natural ingredients (e.g., plant-based extracts) that are biodegradable and target-specific.

Regional Market Insights

-

Asia-Pacific: Dominates the market and is the fastest-growing region, fueled by massive agricultural sectors, densely populated cities in countries like India and China, and improving economic conditions.

-

North America & Europe: Mature markets characterized by strict regulation. Growth here is driven by high-value professional services, technological adoption, and the need to combat resistance with advanced solutions.

-

Latin America and Middle East & Africa: Emerging markets with growth potential due to expanding agricultural exports and urban development, though often with less uniform regulatory frameworks.

Competitive Landscape

The market features a mix of multinational agrochemical giants and specialized pest control companies. Key players include:

-

BASF SE, Bayer AG, Syngenta AG: Leaders in the manufacture of active ingredients and branded rodenticide products.

-

Neogen Corporation, Liphatech, Inc.: Specialists in rodent control technology and bait formulations.

-

Rentokil Initial plc, Rollins, Inc. (Orkin), Anticimex: Global leaders in professional pest control services, driving demand for effective rodenticides as part of their service offerings.

Competition is increasingly based on safety profile, efficacy against resistant populations, and service bundling with technology.

Read More-

https://www.zionmarketresearch.com/de/report/hydraulic-hose-market

https://www.zionmarketresearch.com/de/report/intravenous-infusion-pumps-market

https://www.zionmarketresearch.com/de/report/protein-supplements-market

https://www.zionmarketresearch.com/de/report/melanoma-drugs-market

https://www.zionmarketresearch.com/de/report/rodenticides-market

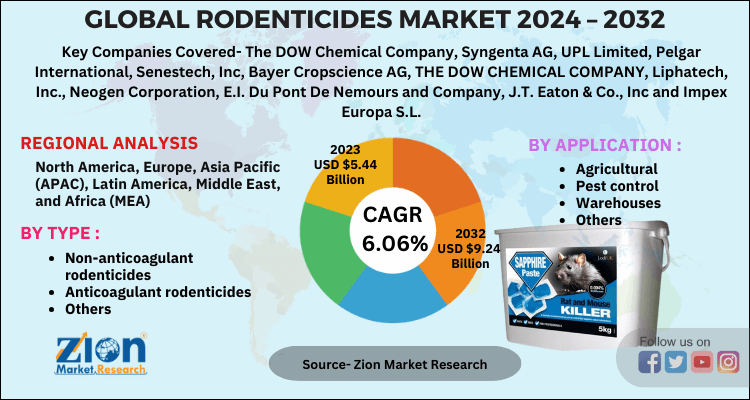

Future Outlook

The rodenticides market is projected to continue its growth trajectory, with a Compound Annual Growth Rate (CAGR) estimated between 4-6% over the next five years. The future will be defined by:

-

Regulation-Driven Innovation: The market will continue to evolve towards smarter, safer, and more environmentally responsible products.

-

Service and Technology Integration: The line between chemical manufacturer and service provider will blur further. Success will belong to those who offer holistic solutions—combining effective chemistry with monitoring technology and expert application.

-

Focus on Sustainability: The industry’s social license to operate will depend on demonstrating reduced environmental impact and commitment to biodiversity.

Conclusion

The rodenticides market is at a crossroads. While the fundamental need for rodent control is stronger than ever, the path forward requires a balanced approach. Companies that invest in developing safer chemistries, embracing digital tools, and aligning with the professional IPM model will be best positioned to thrive. The ultimate goal is no longer just eradication, but sustainable management—protecting human health and economic assets while minimizing ecological impact.