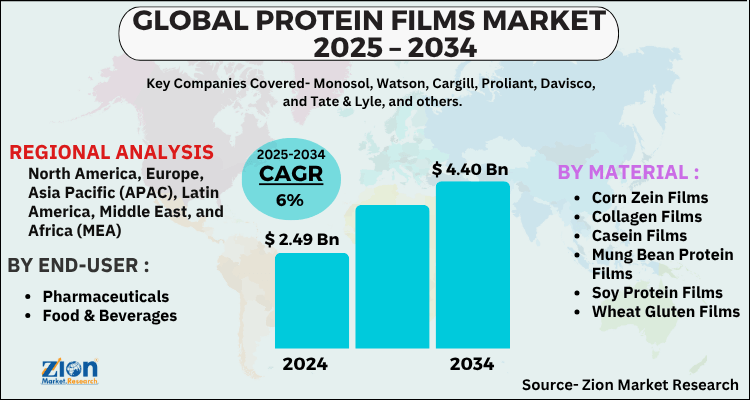

The global push for sustainable alternatives to conventional plastics has catalyzed innovation in materials science, bringing once-niche solutions into the spotlight. Among the most promising are protein films—thin, flexible layers derived from natural protein sources. Once primarily a laboratory curiosity, the protein films market is now transitioning to commercialization, driven by environmental regulations, consumer demand, and advancements in technology. This article explores the market’s dynamics, key drivers, challenges, and future trajectory.

What are Protein Films?

Protein films are biopolymer films produced from proteins extracted from various sources. They are typically created by dissolving proteins in a solvent, adding plasticizers (like glycerol), and then casting or extruding the solution into thin sheets. These films can be either edible (for food coatings) or biodegradable/compostable (for packaging).

Primary Source Segments:

-

Plant Proteins: The dominant and fastest-growing segment due to sustainability and allergen concerns. Includes whey protein (a dairy by-product), casein, gelatin (from collagen), and egg white protein.

-

Animal Proteins: Facing some market headwinds but still valuable for specific applications.

-

Marine Proteins: A small but innovative segment using proteins from fish processing by-products (e.g., fish gelatin, myofibrillar proteins).

Market Drivers: The Forces Behind the Growth

-

The War on Single-Use Plastics: Global legislation (like the EU’s SUPD and various state laws in the USA) is phasing out traditional plastics, creating a massive addressable market for biodegradable alternatives.

-

Consumer Eco-Consciousness: A growing segment of consumers actively seeks products with minimal environmental footprint, willing to pay a premium for sustainable packaging.

-

Food Waste Reduction: Edible protein films can act as barriers to oxygen and moisture, extending the shelf life of fresh produce, meats, and dairy products. They can also be infused with antioxidants or antimicrobials for active packaging.

-

Advancements in Material Performance: Historically, protein films struggled with brittleness and poor moisture resistance. Recent breakthroughs in cross-linking, nanocomposites (adding nanoclay or cellulose nanofibers), and blending with other biopolymers have significantly improved their mechanical and barrier properties.

-

Expansion into Non-Food Applications: The market is expanding beyond food packaging into pharmaceuticals (drug delivery capsules, wound dressing films), agriculture (seed coatings, fertilizer encapsulation), and cosmetics (dissoluble sachets).

Market Challenges: Hurdles to Overcome

-

Cost Competitiveness: Protein films remain more expensive to produce than mass-produced petroleum-based plastics. Scaling up production and optimizing supply chains for raw materials (e.g., plant protein isolates) is critical.

-

Technical Limitations: While improving, protein films can still have variable barrier properties, especially in high-humidity environments. Long-term durability and storage stability are areas of ongoing R&D.

-

Supply Chain & Sourcing: Consistent quality and ethical sourcing of raw proteins (e.g., non-GMO, sustainable fishing for marine proteins) are concerns for manufacturers.

-

Consumer Acceptance & Regulation: For edible films, consumer education is needed. All regulatory bodies (FDA, EFSA) require rigorous safety assessments for new food contact materials.

Regional Landscape and Key Players

-

North America & Europe: These regions are leading in terms of market value, driven by strict regulations, high R&D investment, and strong consumer awareness. The presence of major food and packaging corporations accelerates development.

-

Asia-Pacific: Expected to be the fastest-growing market due to rapid industrialization, government initiatives to reduce plastic waste (e.g., in India, China, and Japan), and a massive food packaging sector.

-

Key Companies: The competitive landscape includes both specialized biotech firms and large conglomerates. Notable players are Kuraray Co., Ltd., MonoSol, LLC (a Kuraray division), Tate & Lyle PLC, WikiCell Designs Inc., Devro plc, DuPont de Nemours, Inc., and Amcor plc, which are actively developing or incorporating protein-based solutions.

The Future Outlook: Transparency and Multifunctionality

The future of the protein films market lies in intelligence and integration. The next generation of films will likely be:

-

Smart/Active: Indicating spoilage via color change or releasing preservatives on demand.

-

Transparent & Brandable: Offering printability for branding while maintaining compostability.

-

Performance-Engineered: Tailored for specific products—a high-oxygen barrier film for nuts, a high-moisture barrier for fresh fish.

-

Circular Economy-Aligned: Made increasingly from upcycled protein sources (e.g., okara from soy milk production, spent grain from brewing, poultry feather keratin), turning waste into high-value material.

Read More-

https://www.zionmarketresearch.com/de/report/digital-polymerase-chain-reaction-market

https://www.zionmarketresearch.com/de/report/automotive-specialty-coatings-market

https://www.zionmarketresearch.com/de/report/home-potassium-monitoring-devices-market

https://www.zionmarketresearch.com/de/report/basketball-apparel-market

https://www.zionmarketresearch.com/de/report/base-transceiver-station-bts-market

https://www.zionmarketresearch.com/de/report/autonomous-mining-equipment-market

Conclusion

The protein films market is no longer a fringe concept but a critical component of the broader bio-economy. While challenges in cost and performance persist, the alignment with global sustainability goals provides an unstoppable tailwind. As technology bridges the performance gap and scale brings down costs, protein films are set to move from specialty applications to mainstream use, offering a viable, earth-friendly shield for our products and food. The journey from lab to shelf is accelerating, promising a less plastic-dependent future.