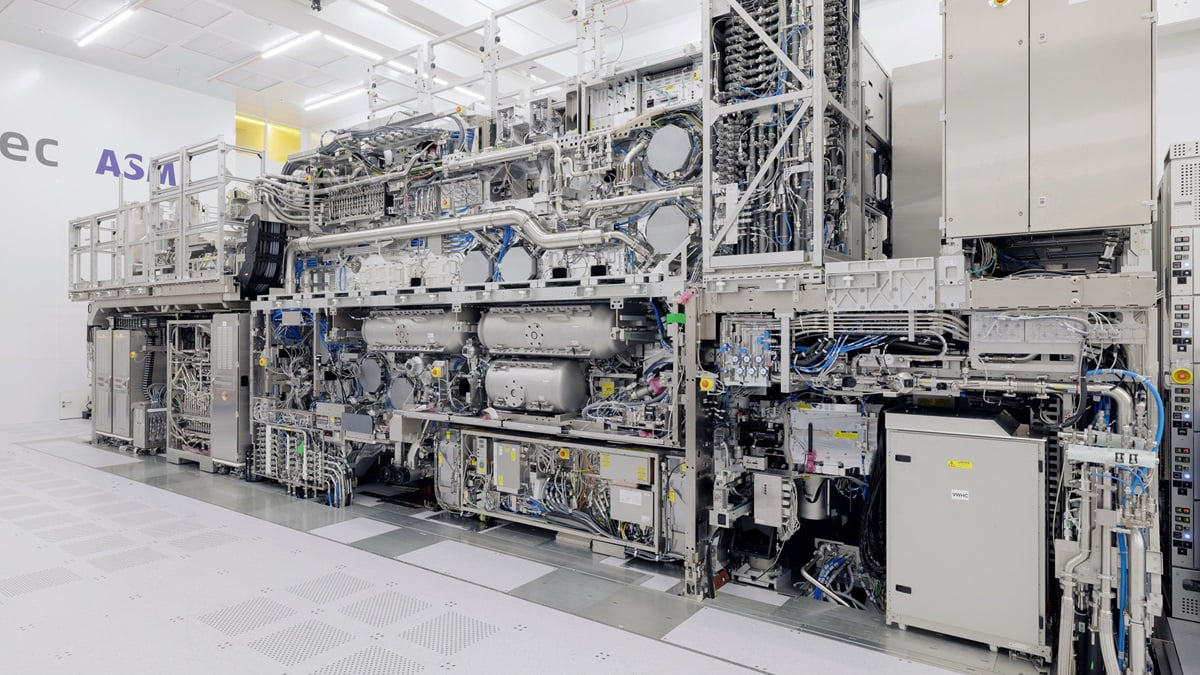

In the invisible engine room of the digital age, where microchips power everything from smartphones to supercomputers, one class of machines holds the master key: lithography equipment. Often described as the most complex and precise machinery ever built, these tools are the linchpin of semiconductor manufacturing, etching the ever-shrinking circuitry onto silicon wafers. The global lithography equipment market is not just an industry segment; it’s a high-stakes battleground defining the limits of Moore’s Law and, by extension, technological progress.

Market Overview: Dominated by Precision, Driven by Demand

The lithography equipment market is a highly concentrated, technology-intensive oligopoly. It is currently valued in the tens of billions of dollars and is projected to grow at a robust CAGR of over 8% in the coming years. This growth is fueled by the insatiable global demand for advanced semiconductors, the proliferation of AI, 5/6G, and the Internet of Things (IoT).

Key Players & Competitive Landscape:

The market is dominated by a handful of giants, each controlling specific technological niches:

-

ASML (Netherlands): The undisputed leader, holding a near-monopoly in the extreme ultraviolet (EUV) lithography space—the technology required for cutting-edge 5nm, 3nm, and smaller chips. Its deep ultraviolet (DUV) systems are also industry workhorses.

-

Nikon and Canon (Japan): Historically major players, they now primarily compete in the DUV and i-line (older technology) segments, serving legacy nodes and specific applications like displays and sensors.

-

Shanghai Micro Electronics Equipment (SMEE) (China): A focal point of national strategy, aiming to achieve self-sufficiency in lithography, though still several generations behind in advanced nodes.

Technology Segmentation: The Evolutionary Ladder

Lithography equipment is segmented by the wavelength of light used, which directly determines the smallest possible feature size (resolution).

-

EUV Lithography: The current pinnacle. Using 13.5nm wavelength light, EUV scanners are the only tools capable of printing the most advanced chip designs. They are marvels of engineering, costing over $200 million each and involving complex plasma sources and mirror-based optics (as lenses absorb EUV light).

-

DUV Lithography (ArFi & ArF): The backbone of the industry. Using 193nm light combined with immersion techniques and multi-patterning, DUV tools produce chips down to ~7nm. They are critical for a vast range of semiconductors.

-

I-line & KrF Lithography: Older technologies used for mature nodes (>28nm), micro-electromechanical systems (MEMS), power devices, and display manufacturing. They represent a stable, high-volume segment.

Key Market Drivers

-

The “More-than-Moore” and “More Moore” Paradigm: While leading-edge logic chips push “More Moore” with EUV, “More-than-Moore” applications (sensors, analog, power) drive demand for diversified lithography solutions.

-

Geopolitical Tensions & Supply Chain Resilience: Export controls and the push for regional semiconductor self-sufficiency (e.g., CHIPS Acts in the U.S. and Europe) are driving massive investments in new fabs, all of which need lithography tools.

-

The AI & HPC Explosion: Advanced AI training requires massive, complex chips (GPUs, TPUs) that are only feasible with EUV lithography.

-

Automotive & Industrial Digitalization: The electrification of vehicles and smart manufacturing is creating unprecedented demand for reliable semiconductors, often built on mature nodes.

Check this-

https://www.zionmarketresearch.com/de/report/gym-equipment-market

https://www.zionmarketresearch.com/de/report/golf-tourism-market

https://www.zionmarketresearch.com/de/report/aerosol-valves-market

https://www.zionmarketresearch.com/de/report/power-amplifier-market

https://www.zionmarketresearch.com/de/report/payment-orchestration-platform-market

https://www.zionmarketresearch.com/de/report/circular-fashion-market

Critical Challenges & Constraints

-

Extreme Complexity & Cost: The R&D and production cycle for a new lithography machine can exceed a decade and cost billions. This creates immense barriers to entry.

-

Supply Chain Bottlenecks: A single EUV machine contains over 100,000 components from thousands of specialized suppliers worldwide, making the supply chain fragile.

-

Technological Physics Limits: As features approach atomic scales, challenges like quantum effects and stochastic variation become formidable, forcing the development of High-NA EUV (the next generation) and complementary technologies like nanoimprint lithography.

-

Skilled Talent Shortage: The operation, maintenance, and innovation of these systems require a rare breed of physicists, engineers, and technicians.

Future Outlook & Emerging Trends

-

High-NA EUV: The next revolution. ASML’s upcoming High-Numerical Aperture EUV tools will offer higher resolution for sub-2nm nodes, with the first systems slated for delivery to leading chipmakers like Intel.

-

Geopolitical Fragmentation: The market is fracturing along geopolitical lines, with distinct equipment and supply chain ecosystems likely to develop in the West and in China.

-

Advanced Packaging & Heterogeneous Integration: As scaling single dies becomes harder, lithography for advanced packaging (e.g., TSMC’s SoIC, Intel’s Foveros) is gaining importance to connect multiple chiplets into a single system.

-

Exploration of Alternatives: While EUV reigns, research continues into next-generation technologies like EUV Lithography (EUVL) and directed self-assembly (DSA), though these remain in exploratory stages for production.

Conclusion: The Master Tool of Modernity

The lithography equipment market is more than a business; it is a critical infrastructure of the 21st century. It sits at the intersection of cutting-edge physics, global economics, and geopolitical strategy. As the world becomes increasingly data-centric, the ability to pattern silicon with ever-greater precision will remain the fundamental determinant of computational power and innovation. The companies and nations that master this precision frontier will continue to shape the technological destiny of the next decade.